This article is being co-posted on Maple Leafs Hot Stove as well as on my own site, www.originalsixanalytics.com. Find me @OrgSixAnalytics on twitter.

I recently completed a three-part series on the Wins Above Replacement (WAR) and Goals Above Replacement (GAR) metrics.

In it, I summarized how the GAR metric can be used for player evaluation, how it can be used to calculate player value, and how GAR can be used to derive an entire team’s salary cap ‘efficiency’.

I’d like to add one last bonus article to the series to touch something I have often mentioned: the massive importance of Entry Level Contracts (ELCs) and Restricted Free Agency (RFA) years in a salary capped league.

In this piece, I will touch on, (i) the impact of negotiation leverage on contract discussions, (ii) how to quantify the value of ELC and RFA deals to teams, and (iii) a short review of these things in practice by looking at Steve Yzerman’s impeccable handling of Jonathan Drouin’s trade request situation. By the end, I will hopefully demonstrate the immense amount of value for teams that ELC/RFA contracts can create – which further establishes the importance of building through the draft, as well as generally acquiring players at the very early stages of their careers.

Market Dynamics and Negotiation Leverage

How negotiation leverage impacts transactions (e.g. trades, contract signings) is something I think most people understand intuitively. Whether inside or outside professional sports, in any transaction the buyer wants to minimize the price paid for an asset, and the seller wants to maximize it. The way market dynamics play into this is driven by the options available to both parties. If a seller has a scarce asset, and can get 5-10+ interested potential buyers (e.g. resembling an auction), the seller is in a position of strength and will likely get an excellent return. This can even hold true with as few as two or three serious buyers. However, if a buyer is somehow able to get into an exclusive, one-on-one negotiation with a seller, that buyer instead holds significant leverage, especially if the seller is ‘forced’ to get rid of the asset.

Although this is true in every-day scenarios (e.g. to get a good price, it is better to look at three retail stores when buying a new TV, not just one), a great example of the market dynamics side is buying a house. Toronto’s housing market is currently quite ‘hot’, with five-plus buyers bidding on most houses. As a result, almost every single one trades for a premium to its asking price. Like I said, intuitively I think we all already understand these fundamental concepts.

Now, in the case of hockey, there are two primary situations where negotiation leverage becomes important:

- Player-Team negotiations

- Team-Team negotiations

For what it’s worth, NHLPA-NHL negotiations also take place, essentially becoming Player-Team talks at the level of the entire league.

In this article, I will be focusing on team-player negotiations, in particular on the substantial impact that ELC/RFA constructs have on them. However, for those interested, my last post touched on the team-to-team side briefly, discussing how the strong trade deadline demand for defensemen and weak demand for goalies impacted the Leafs’ yield on Roman Polak and James Reimer, respectively.

How do Entry Level Contracts (ELCs) and Restricted Free Agents (RFA) Work?

Before quantifying the value of the ELC/RFA concepts, I will give a brief summary of how they work, simplifying it into three categories: (a) ‘ELC’ deals, (b) ‘RFA’ deals, or (c) ‘UFA’ deals (Unrestricted Free Agent) – driven by age at signing and years played in the league. However, keep in mind this is a high-level summary, as these concepts fill a number of sections in the Collective Bargaining Agreement (CBA) and free agents are actually divided into six distinct categories. For those who want a very detailed walk through of these concepts and the rest CBA, I recommend you check out @JJfromKansas’ great 2013 series ‘Getting to know the CBA’.

At a high level, Entry Level Contracts:

- Apply to players in their first three seasons in the league, with seasons defined different depending on the player’s age

- Also typically expire when a player turns 25, if that player has not yet reached three seasons

- Limit players’ base salary to a maximum of $975K, or a cap hit of $3.8M after including possible performance bonuses (regardless of if those bonuses are paid)

- Cannot include no-trade/no-movement clauses, and must be two-way contracts

Following a players’ ELC, they enter Restricted Free Agency. RFA players:

- Will be an RFA either until they turn 27, or until they have played 7 professional seasons

- Are only able to negotiate with the team that holds their exclusive rights

- Other teams can extend RFAs an ‘offer sheet’, but generally (i) the current team can match it, or (ii) the current team will be compensated by the ‘poaching’ team with draft picks

- Compensation ranges from a third round pick for players earning $1.1M-$1.6M per year to four first round picks for players making $8.4M+ per year

- Also prohibit no-trade/no-move clauses during RFA years

- As long as teams extend RFAs a ‘qualifying’ offer, players have limited leverage in the negotiation, with the exception of invoking (or threatening to invoke) arbitration.

Unrestricted Free Agents (UFAs) are just that – the first time a player can ‘test’ his value on the open market, unencumbered by the CBA. For what it is worth, I currently have no strong view on if this system is fair or not. As of right now, these are the rules of the game, so they are what they are.

ELCs/RFA deals are specifically designed to give teams negotiation leverage over players early in their careers – with ELCs putting a direct cap on that player’s salary, and RFA’s implicitly stifling their compensation by forcing them into one-on-one negotiations.

To be clear, just based on the ever-increasing value of draft picks in trades, all GMs already know that these ELC/RFA years are hugely valuable. This is not an innovative or original concept. However, what is less clear is whether many NHL teams understand exactly how much these rights can ultimately be worth to them.

As such, I now want to attempt to answer:

What Is a Player’s Exclusive Negotiating Rights Worth to a Team?

We won’t be able to get an ‘exact’ answer to this question, because it is a very theoretical concept and is entirely dependent on which actual player is being discussed. As a result, I will instead use an illustrative example that shows – for a particular set of players – how much value they contributed to their respective teams over each of their ELC/RFA/initial UFA years in comparison to how much they were paid during that time. The method I will use to determine what a player is ‘worth’ is the exact same as I used in my previous articles, so I encourage you to check those out if the math is unclear.

To start, I selected a sample of elite-level players, to illustrate the extreme end of the spectrum in terms of contribution to their teams. I selected 10 forwards from across the league who have (almost all) reached the UFA portion of their contracts. Here is the sample I looked at:

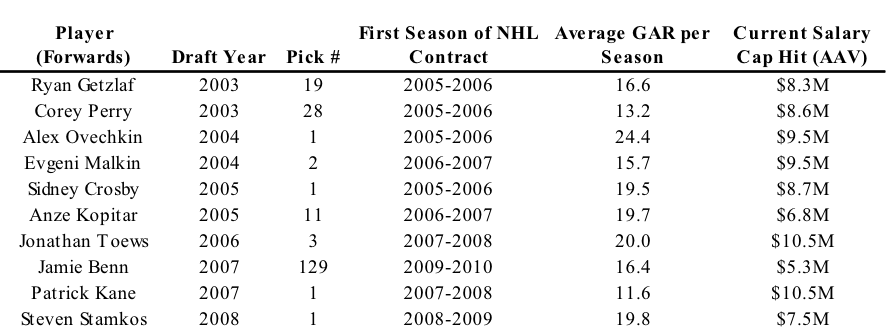

First, I stacked up all of these players next to each other in terms of their annual salary cap hits (Average Annual Values, or AAV), with data from General Fanager. Here is the group’s average AAV per player over their first 10 NHL seasons:

(Note: Although players become UFAs after seven years played, all of the players listed were signed to at least a five-year deal when their ELC expired. As a result, teams earned the savings on these players’ contracts up until their 8th NHL seasons, and I have treated their 8th season as a year locked into an ‘RFA’ contract)

Just from this you can already see the huge impact that ELC and RFA years have on a players’ compensation. These guys are the equivalent of slave labour in their first three seasons when compared to their contributions/value.

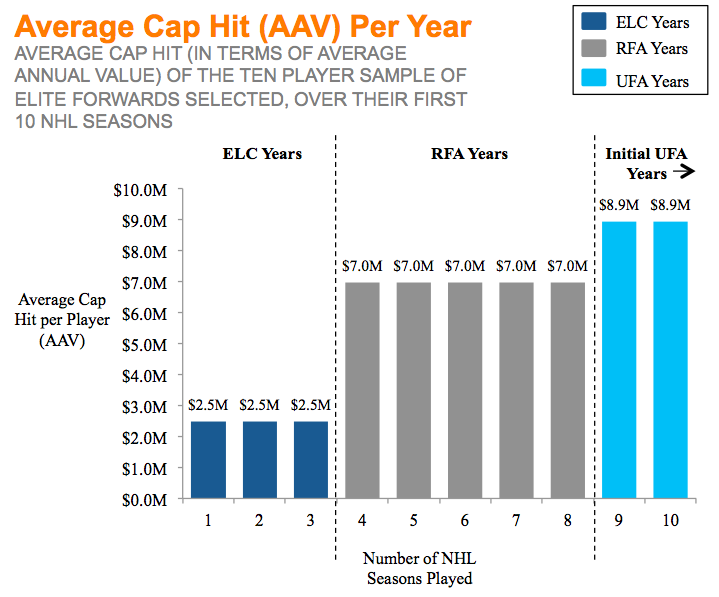

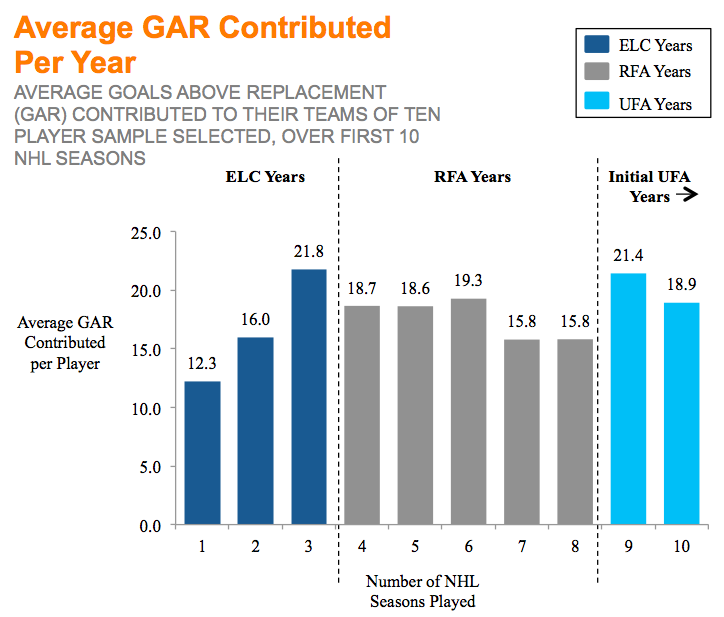

Next, in order to derive what these players are worth to their respective teams, I calculated their average annual GAR contributions, as well as what those GAR values should be worth based on Hawerchuck and Eric T’s relationship between WAR/GAR and contract dollars (e.g. AAV FMV =$575K + ($467K * GAR)).

(Note: For those who had not yet reached 8-10 seasons of data, I estimated the last couple years of GAR data based on that player’s 3-yr Avg GAR, and the player’s UFA AAV was treated as equal to their FMV. This was only the case for one or two players)

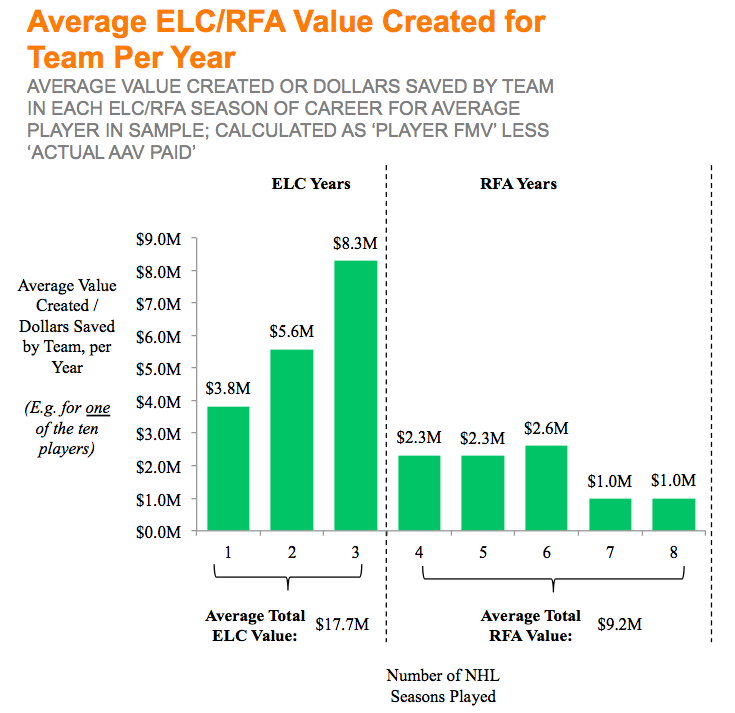

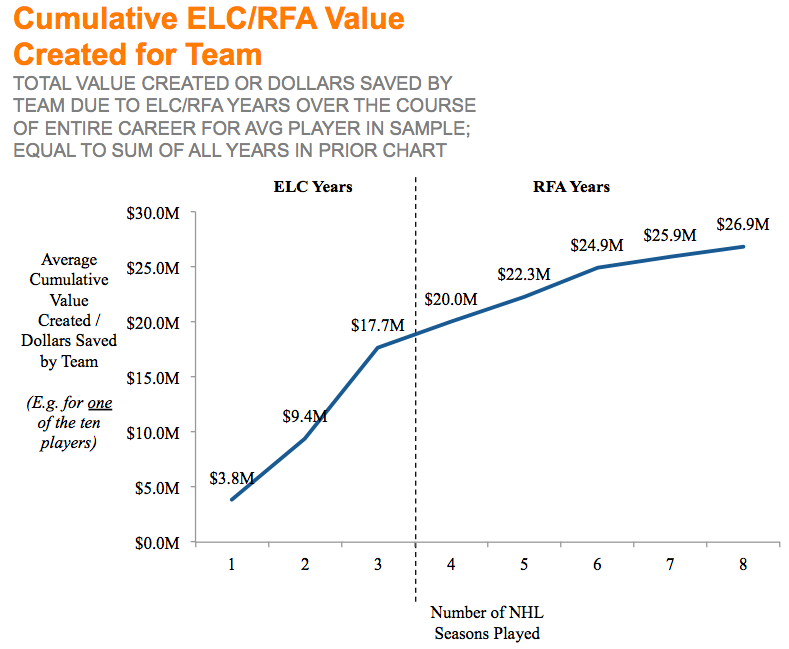

Lastly, I calculated the amount teams’ saved, on average, in each year of these players’ contracts. In short, this was done by subtracting the average actual AAV (e.g. Chart #1) from the value contributed / FMV of these players to their teams (e.g. Chart #3, above). Here is the result, on both an individual year and a cumulative basis:

I think this tells us a very interesting result: for the contribution made by this type of elite, franchise player, the combination of ELC and RFA years equate to almost $27M in salary cap dollars saved by their teams. Further, the vast majority of this is driven by ELC years – players get only slightly less than FMV in their 4 or 5 RFA seasons. I don’t know about you, but I was a bit blown away by the huge amount of value this can create for teams.

And again – to be clear – because these are 10 of the highest-performing players in the league, this illustrative analysis shows essentially the maximum that ELC/RFA years could be worth, not the league average, nor what ELCs/RFAs will even ‘usually’ be worth. On the other end of the spectrum — replacement level players who make the league minimum salary ($575K per year) – there is little to no incremental value in these years, as those players are not commanding premium prices in the first place.

Negotiation Leverage in Practice: Jonathan Drouin vs Tampa Bay Lightning

Finally, I want to bring this all together in a specific example, where Steve Yzerman (GM of Tampa Bay Lightning) demonstrated a clear understanding of his own negotiating position, as well as of the value of ELC/RFA deals in his recent interactions with Jonathan Drouin. For those who don’t know, Drouin is a former third overall pick, still on his entry level deal, who was apparently having issues with Jon Cooper, Tampa’s head coach. As a result, Drouin privately requested a trade at the beginning of the season, and went public with his request in early 2016. In January, Drouin was then sent to Tampa’s AHL affiliate, the Syracuse Crunch, where he eventually chose not report to play and was subsequently suspended by his team. As the trade deadline approached, Drouin was the subject of many trade discussions, with other teams in the league likely trying to take advantage of Yzerman’s seemingly ‘forced seller’ position, presumably giving him slightly ‘low-ball’ offers for the young star.

However, it is now clear that Yzerman fully understood his negotiating position and level of control over the situation as it was unfolding. Further, he seems to have had the foresight to avoid setting a precedent that if a player (with zero leverage) were to complain enough the team would ultimately cave. Based on the analysis above, I would guess that Yzerman knew very well that he had up to $27M in salary cap efficiency he was going to lose if he dealt Drouin for less than his fair value, so his ask from other teams was rightfully high. As a result, no team stepped up with a good enough offer, and Tampa Bay kept Drouin at the deadline – fully understanding the risks.

Now, with the recent news this past week, it appears the situation has come full circle. Drouin has apparently realized that Yzerman is no pushover, and if he ever wants to play hockey in the NHL again he will have to do so as the Tampa Bay Lightning see fit. Lo and behold, earlier this week Drouin approached Yzerman about being willing to play for the Syracuse Crunch, has reported to the team, and apparently they’ve even had conversations about Drouin possibly coming back into the fold for Tampa’s playoff run. Although we knew Yzerman’s trade ask was high, many observers likely thought that the pressure on Yzerman was so great that he would be ‘forced’ to off-load Drouin at below his fair value. Instead, Stevie Y recognized his leverage in the situation, stood his ground, and will either reclaim one of his top prospects or at least be able to trade him for full value in the future.

Well played, Steve.

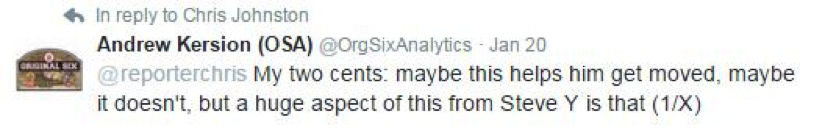

PS – Here was my take on the situation back in January, shortly after it was announced that Drouin had refused to play for Tampa’s AHL team, in an effort to force Yzerman’s hand to trade him:

Conclusion

Hopefully this provided an interesting look at how negotiation leverage impacts contract situations, the huge value of ELC and RFA deals to teams, and also a useful example of this playing out in reality. In the end, it should now be clear that there is a huge amount of hidden value in getting a player at the front end of his ELC/RFA years – up to $27M, in fact. Lastly, I think it is clear that Steve Yzerman has successfully sent a message to his players, and potentially the league, that they are a team with a clear understanding of these two concepts, they are steadfast negotiators, and that Tampa Bay is not an organization to that will be pushed around — especially when they find themselves in a position of strength.

![New Leaf Anthony Stolarz on the opportunity in Toronto: “In Florida, I knew my role as a backup… Now, [Joseph Woll] and I are competing for starts… As a goalie, that’s all you can ask for” Anthony Stolarz, Stanley Cup win, now Maple Leaf](https://mapleleafshotstove.com/wp-content/uploads/2024/07/anthony-stolarz-sc-100x70.jpg)