This article is being co-posted on Maple Leafs Hot Stove as well as on my own site, OriginalSixAnalytics.com. Find me @OrgSixAnalytics on twitter.

“We have a five-year plan that changes every day”

– Lou Lamoriello

I recently wrote an article focused on estimating the value of Steven Stamkos’ production over the next seven years. In it, I concluded a ‘fair’ price for a player of his calibre would be $9M-$10M for the maximum term (7 years). Further, I suggested that – given Steven’s negotiation position resembles an auction – we should expect Stamkos to find a team willing to give him the high end of that range.

So, the next logical question posed by fellow Leafs fans:

“Okay, Stamkos is worth a lot. But does it make sense for the Leafs to pay him that much?”

In this article I will walk through a detailed review of the Leafs’ cap over the next 7 years, and the strategic questions facing them. Looking at this analysis, my own conclusion is that Toronto should definitely attempt to sign Steven Stamkos; however, like in any negotiation, they should do so own their own terms, and only in a manner that fits within their broader salary cap strategy.

Let’s get into it.

Approaching Long Term Salary Cap Analysis

Teams must consider a wide range of factors when planning their long term salary cap management. Besides ‘team-level’ factors, like on-ice strategy and their ‘competitive window’, there are a range of factors that must be evaluated for each individual player signed (on both a near term and long term basis):

- Historical/recent production

- Future production

- Player ‘valuation’/expected cost

- Fit with team cap situation/financial strategy

- Negotiation dynamics (large scale bidding war vs one-on-one negotiation)

- Player health circumstances

- Opportunity cost (e.g. other players)

- Etc.

Naturally, writing an article that goes in depth on all of these topics would take thousands of words, so I will have to narrow my focus somewhat. Today I will be focusing strictly on the financial side: how to analyze a team’s salary cap strategy and contract commitments over the long term, and what that tells us about the Leafs’ decision to pursue Steven Stamkos.

Before getting into the Leafs’ cap situation, I want to first talk about (i) the principles behind this type of analysis, and (ii) an example of a team who has managed their cap along these principles in the past.

‘Asset-Liability Matching’

A major principle used by financial services companies is the concept of ‘matching’ assets to liabilities. In the case of banks, insurance carriers and pensions, this means forecasting the future payments to their clients, and then building portfolios of assets (investments) to match when those liabilities will become due over time.

This line of thinking is extremely applicable for the strategic management of a salary cap. In the NHL the ‘assets’ are players – represented by a bottom-up forecast of each player’s individual production – and the ‘liabilities’ would be the length and term of each player’s contract. Production could be considered as either basic goals/points or as advanced stats like Goals Versus Threshold (GVT)/Goals Above Replacement (GAR).

The objective of this exercise is to closely match the value of your players (assets) to the cost you incur to secure them (liabilities) over time – while maximizing total value. In the interest of time, I will not be building a Stamkos-like production forecast for the entire Leafs’ roster. Instead, I will focus strictly on the liability side of the equation, and try to build up the estimated contract dollars and term for all of TML’s future ‘core’ players.

Before getting into the Leafs, let’s look at an example of an organization that has applied this approach beautifully in the past.

Salary Cap Management: Best Practices

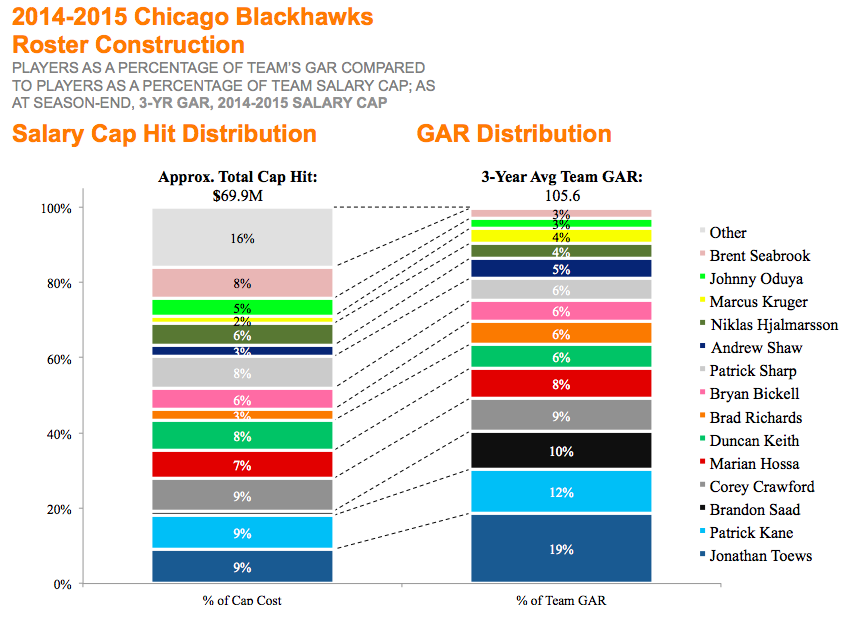

Despite their recent first round exit, Stan Bowman’s Chicago Blackhawks represent one of the model franchises in today’s NHL (as I have previously written about). Borrowing a chart from that article, you can see that Bowman has been able to closely match each player’s proportional contract dollars and total production when compared to the team as a whole.

As you can see, most of Chicago’s top 8-10 players in AAV (average annual value) closely match their top 8-10 players in terms of Goals Above Replacement, with many ‘outperforming’ their cost to some degree (e.g. Saad).

Looking at Chicago and others around the league, the best practice appears to be assembling a ‘core’ of players that can be secured for the long term. These core contributors typically represent ~60-80% of the team’s cap, while the remaining 20-40% can be dedicated to short term contracts, strong prospects on ELC deals, and cheap, role-playing replacement-level players for depth and filling specific needs.

Now – enough pre-amble – let’s talk about the Leafs:

TML’s Long Term Cap Strategy

To analyze the Leafs’ salary cap, I will to look at:

- Current contract commitments

- Estimating future cap constraints

- Estimating future commitments to ‘core’ players

Ideally, this analysis will both help us understand Shanahan and Lamoriello’s (and namely, Brandon Pridham’s) plan for the organization, as well as whether or not Stamkos fits within it.

To be clear, the upcoming analysis uses almost entirely estimates and will require many placeholders to complete it. As a result, this analysis as a whole should be considered ‘illustrative’.

TML’s Total Contract Commitments

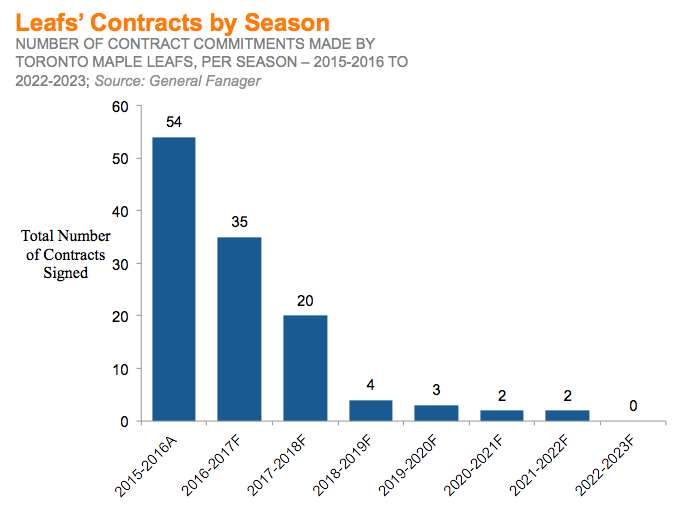

Given the NHL has a 50 contract limit per team, let’s start by looking at how many players the Leafs have committed to over the next seven seasons (all data here is courtesy of GeneralFanager.com).

(Note: Although the league limit is 50 contracts per team, General Fanager caveats that six of the Leafs’ contracts in 2015-2016 are exempt: Zaitsev, Marner, Dermott, Kaskisuo, Nielsen, and Timashov)

Beyond the 2015-16 season, Toronto has a solid amount of flexibility in terms of total contracts. However, the number of contracts is likely the smallest piece of the puzzle. Salary cap dollars will be the more important factor.

Historical/Future Salary Cap Growth

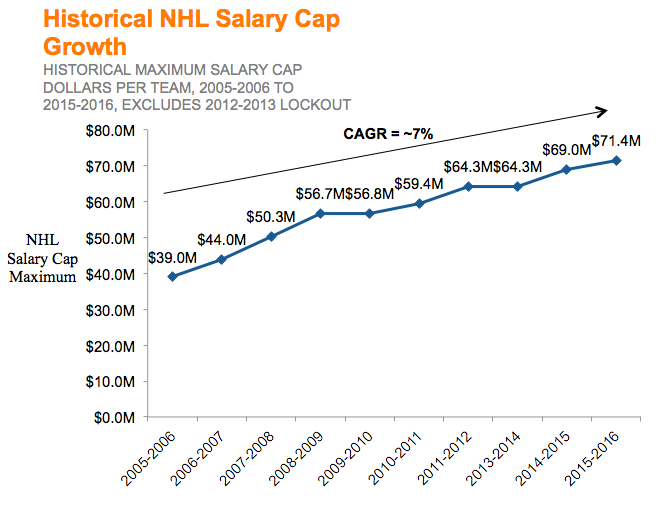

In order to have a meaningful projection of the Leafs cap, we first need an estimate of their future cap constraints. To gauge that, let’s first look at the growth of the salary cap over the last 10 years:

This chart shows the NHL salary cap can change dramatically over time; it rose from $39.0M in 2005-06 to $71.4M this year – a CAGR (compound annual growth rate) of 7%.

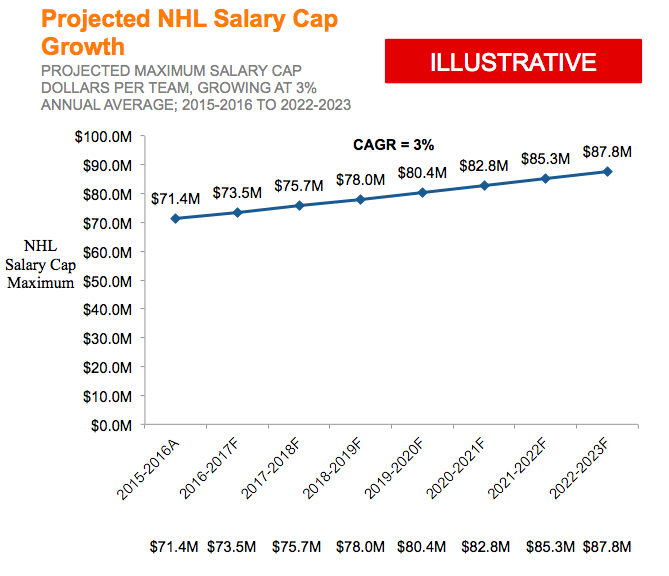

However, we shouldn’t assume this rapid growth will continue, especially given the recent weakening of the Canadian dollar. Instead, I have projected the future annual salary cap growth rate to be roughly ~3% on average, shown in the chart below.

Given the NHLPA’s tendency to use its ‘inflator’ clause, along with the general currency inflation rates in Canada and the US being in the 2-3% range, I consider this 3% estimate to be a conservative assumption. Although the chart above will likely be wildly incorrect on a year-to-year basis, over the long term it will serve our purposes of providing a conservative estimate to be used going forward.

Leafs’ Existing Contract Commitments

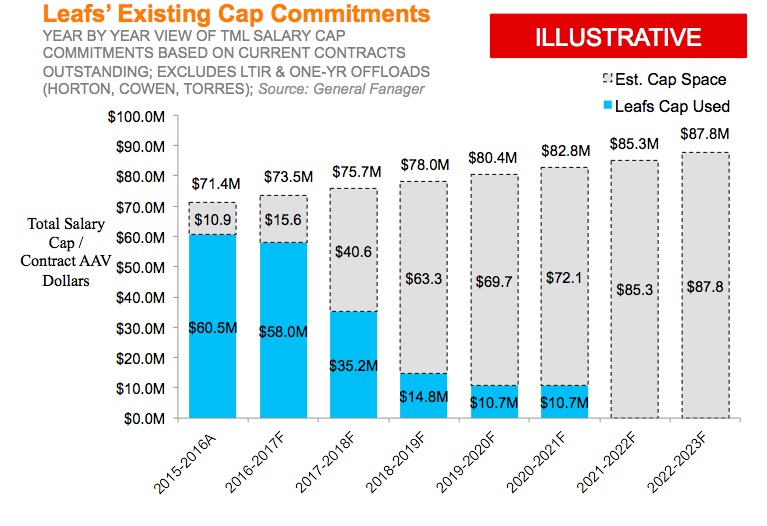

Now, let’s look at the contract dollars the Leafs have already committed against their salary cap:

Much like the last chart, you can see the Leafs have some flexibility for the upcoming season, with roughly ~$16M of cap space available (assuming the 3% growth materializes). After 2016-17, the Leafs have a huge amount of cap space available, in large part thanks to their trades of Phil Kessel and Dion Phaneuf over the last two seasons.

Although the upcoming sections will be focused on the 3+ year future for the Leafs, for anyone interested in a detailed review of the 2016-2017 and 2017-2018 Leafs rosters on a player-by-player basis – check out this great post by @yakovmironov from Bloggers’ Tribune.

TML’s Future ‘Core’ Players

When looking to the Leafs’ future, I will focus my efforts on the Leafs’ ‘core’ players and rough estimates of these players’ future contracts. As the Blackhawks’ strategy shows, the other ~40 contracts will likely change on a year-to-year basis, so it makes sense to focus strictly on the major assets. Although some other players may warrant inclusion, I think most fans would agree on the following guys:

- Nazem Kadri

- William Nylander

- Mitch Marner

- Auston Matthews (assuming they take him)

- Jake Gardiner

- Morgan Rielly

- Nikita Zaitsev (assuming Zaitsev plays out as hyped; otherwise, consider him a top-3 D placeholder)

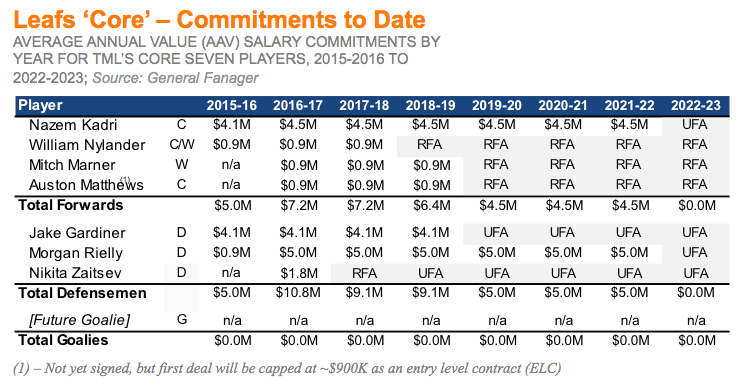

Of these seven guys, the Leafs recently locked up Rielly and Kadri until 2021-22 – six years each – and have three years left on Jake Gardiner’s contract. Of the players omitted, the strongest argument for inclusion would be JVR. Given Van Riemsdyk’s UFA deal will likely be significantly more expensive than his current one (at $4.25M AAV until 2017-2018), I have not included him in the ‘core’ group; however, I will re-visit JVR later on.

Let’s look as this group as a whole in terms of dollars that have been committed to them to date:

Notably, the Leafs’ don’t currently have an answer for their long term option in net. Maybe Reimer returns, or maybe Kasimir Kaskisuo becomes the long term option – it is too soon to say. Regardless, having a number-one goalie is essential to any teams’ success, so I have included a placeholder for the Leaf’s future goalie in my analysis.

Forecasting the Leafs’ Next Seven Years of Salary Cap

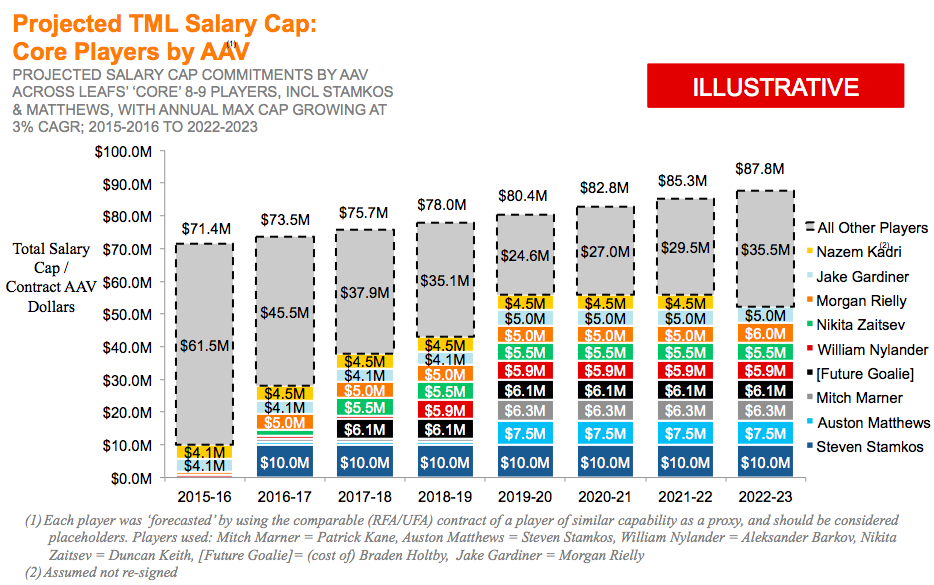

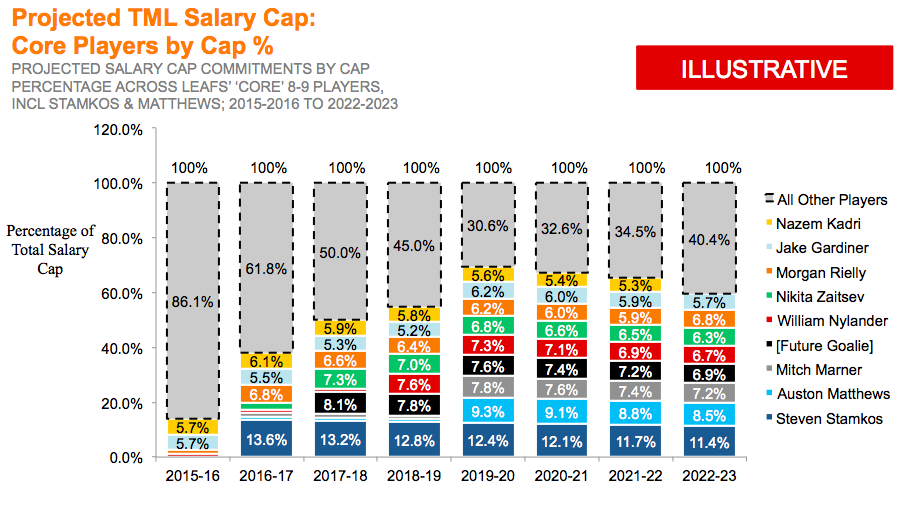

Although the Leafs’ core players don’t have huge contracts yet – those deals will eventually come. The issue Stamkos presents is 3-5 years down the road, when many of these young stars need new, big-dollar deals. In order to understand how much space the Leafs could offer to Stamkos while not sacrificing their top young talent, I have estimated the AAV of each core player’s next contract. To do so, I simply picked a relatively comparable player for each and used the comp’s AAV as a proxy (see footnotes for specifics).

The next two charts summarize a high-level view of the Leafs’ future cap situation, both in absolute dollars and as a percentage. I have included Steven Stamkos for the sake of illustration.

Looking at the charts above, I think there are reasonable grounds to argue the Leafs should pursue Steven Stamkos, given:

- The Leafs project to have ~$25M in cap space remaining in their tightest future year (2019-20), representing 30.4% for non-core players, or almost exactly the amount of the 2014-15 Blackhawks.

- Assuming long term salary cap inflation, this number continues to slowly decline thereafter.

Based on the above, I think it is safe to conclude that there is space for Stamkos within the Leafs’ future salary cap. Naturally, we could debate the appropriate number to project for each player, but treating the ‘core’ as a whole, I think the outcome will be largely the same. Some fans may argue they would rather have three or four more of the current Marlies for 4-7 years than have Stamkos; however, I personally subscribe to the view that NHL teams require ‘elite’ talent (15-20+ GAR) to win a Stanley Cup – not just a lot of ‘good’ talent.

One last note: including JVR at $6M per year starting in 2018-19 would put the Leafs at 77% of the cap allocated to a core of 10 players (in 2019-20). I think this is the absolute high-end of the range to give to a core group. That said, it would be hard to argue with the strength of that set of top-six forwards and top-three defensemen, all ideally supplemented by a goalie that deserves the $6M per year being allocated to his position.

Before wrapping up, I want to touch on two final areas: mitigating ‘overpayment’ risk, and TML’s negotiation strategy.

Minimizing ‘Overpayment’ Risk

Many fans are concerned that signing Stamkos’ could create a cap drag in the last 3-4 years of his deal. Generally, I agree that this is a reasonable concern. But as I mentioned earlier, I believe the Leafs should attempt to sign Stamkos, but only do so on terms that fit their own strategy and needs.

The Leafs can limit their overpayment risk by refusing to give Stamkos a full No Move Clause (NMC) or No Trade Clause (NTC). Instead, they should only offer deals with a modified NTC (allowing Steven to list ‘X’ teams he will accept a trade to). A modified NTC is a strong hedge against the potential downside of the Leafs overpaying Stamkos, as even if he declines, they likely will be able to offload him for some combination of picks, prospects and retained salary. There happens to be a clear precedent for this clause in Stamkos’ UFA comparables — 50% of them (Ovechkin, Nash and Kessel) have agreed to modified NTCs. Last, the Leafs would also be wise to front-load Steven’s cash compensation (salary), to increase his outer-year appeal to ‘budget’ teams that are cash-poor but have ample cap space.

Side note – @yakovmironov also included a great table in his article that summarizes the production of many 33-year old NHL players (Stamkos’ age in the final year of his contract) –it isn’t as bad as you might think.

Approaching the Stamkos Negotiation

Based on all of the information above, I think the Leafs should give Stamkos an ‘opening offer’ of $9.5M for 7 years, including a modified NTC for the duration of the contract. Depending how the negotiations proceed, I would recommend Toronto be willing to increase this offer up to $10M per year, and to reduce their NTC to only the final 3-4 years of his term. I personally suspect that, if he has interest in coming to Toronto in general, Stamkos would be willing to accept somewhere in this range. However, as in any negotiation, it is essential that Toronto knows their maximum offer and are willing to walk away from the deal if Stamkos pushes for anything beyond it.

Conclusion

Overall, I think the Leafs would do very well to try to sign Steven Stamkos this July. Stamkos is an elite shooter, a former first-overall pick, and a potential captain who could lead Toronto through a key stage of their rebuild. Projecting forward the Leafs’ core talent shows there should be a reasonable amount of room in the Leafs’ cap space for him, while keeping roughly ~30% of their salary cap to be allocated outside the top ~10 players on the team. Finally, by only offering Stamkos a contract that includes some version of a modified NTC – and otherwise walking away – the Leafs can carefully mitigate their biggest risk in this contract while also signing a hugely valuable asset at the same time.

In the end, I suspect the Leafs’ front office has a very clear view of their current long-term roster construction plans, approach to salary cap management and their strategy for negotiating with Stamkos and his agent. As a result, all that is left for us fans to do is to sit back and count down the days until July 1st.